Let's face it, business involves numbers and calculations. Major corporations and companies use quantitative studies in various stages in their day-to-day operations, to make sure they’re bringing home the bacon.

This use of quantitative data is crucial for CEOs and investors to conceptualise a project, profit margins, sales data, marketing conversion rates, and profits per sale. Like how peanut butter and jam make for a great sandwich, one must have good mathematical skills and quantitative data to make decisions that result in profits, with the least amount of risk.

Some of the types of mathematical data involve percentages, averages, statistical data, and median outcomes. These data can, and have been, used in day-to-day business operations.

Take ‘average per receipt’ for example. This data informs the company how much an average shopper would potentially spend in a single receipt. We’ll be shedding some light on these percentages, calculations, and how you could utilise them in your business field.

The Longman Dictionary of Contemporary English defines percentage as ‘an amount expressed as if it is part of a total, which is 100’. Percentage basically means ‘out of 100’. To calculate the percentage of a quantity, divide the amount by the total number, then multiply by 100. For example, 100 ÷ 250 x 100 = 40%.

Now, if an item was sold for $74.50, and $25 out of that is profit, the calculation is 25 ÷ 74.50 x 100 = 33.55% profit.

If a business must charge a 10% service charge on a meal of $125, here's the calculation below for the total bill:

Following the calculation shown above, the total bill amount that would be charged to the customer is $137.50.

Percentage changes are used for the depreciation or appreciation in the value of an asset. You usually hear uncles complaining about how their property bought from 2000 has dropped in value, due to the economy. You can calculate that drop in percentage, and we’ll show you how below.

Each cycle's depreciation quantity is calculated using this formula:

Annual depreciation rate/ number of cycles per year

For example, in a 15-cycle year, if the asset's expected life is 80 months, the annual depreciation rate for the asset is: 15/80 = 18.75%, and the depreciation rate per cycle is 18.75% / 12 = 1.5625%.

Quick tip: You can learn more about depreciation changes here.

Another type of percentage change is in stock trading. This uses basic mathematics to find the percentage change in a stock price over a set period of time. The percentage change can start from the year-to-date, from whence the trader started trading, or quick changes in day-to-day trading.

The formula for percentage change in stock value is:

(New Price - Old Price) / Old Price x 100

A positive percentage indicates an increase in stock value, whilst stocks dropping in value is denoted by a negative percentage.

Say MediaCorp closed at $575.25, and by 3pm the next trading day, was up at $636.47, an increase of $61.22. At 3pm, any investor trading on the floor will notice an increase of 10.64% in MediaCorp's shares.

Sales percentages are essential data for making important financial decisions by the company. A lot of this data is used to track and reflect the company’s financial records, and knowing how to utilise sales percentages is important to run a business. Below are a few examples of sales percentages and how to calculate them, formulas included!

To calculate gross profit margin, use the following formula:

Following the figures in the formula above, the 80.6% refers to the profit obtained by the company after selling their goods. With this, you can now track how much profit your company makes, as well as set target profit goals for the future years.

When you take a loan from the bank or a licensed moneylender, you have to pay the cost of obtaining the loan: Interest! Knowing how much interest is being charged on loans, fixed deposits, and investments allows you to make better financial decisions and avoid any debt trap.

Simple interest is calculated by taking the daily interest rate and multiplying the by the principal sum, then by the days in between payments. So, if you invested $15,000 in a fixed deposit that accrues 3% per year...how much money would you have accumulated after 15 years?

$15,000 x 0.03 x 15 = $6,750. You make $6,750 in interest for the 15 years you have kept your money in a fixed deposit scheme.

Compound interest is the interest you earn on interest. If you’ve invested $10,000 and earned 5% interest per annum, you'll get $10,500 at the end of the first year and then it compounds, so at the end of the second year, you get $11,025.

Mortgages and credit cards usually run on the compound interest system. It’s a bit ‘confusing’, as the principal sum changes each year due to the accrual. Most corporations hire or use software to perform these complex calculations. For example, be sure to pay your credit card debt on time, otherwise your interest is going to snowball!

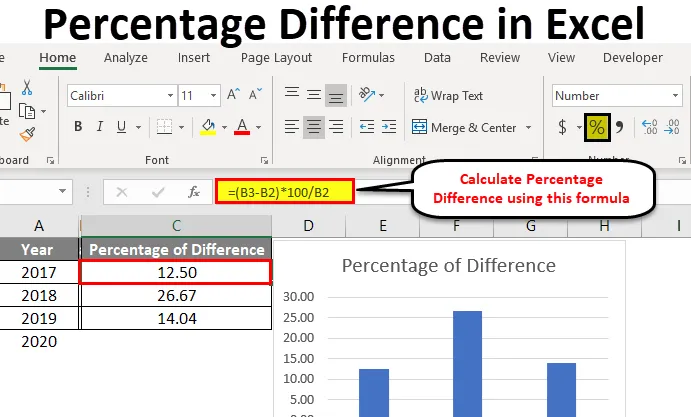

We get that all these numbers and formulas are making you see question marks. Fret not, Excel makes calculating the data you need impressively easy! Firstly, open up Excel and type (=) in a cell. This is the way you initiate Excel to do a calculation for you. Key in the equation you want to calculate. For example, 75 x 100 / 25. Press ‘Enter’. Excel will automatically calculate and display the answer in the cell. Easy!

Quick tip: Click here to learn all the basic arithmetic functions of Excel and how to use them!

Making use of Excel for your business administration needs is a great hack to avoid paying an accountant, or buying premium business software. However, know that most businesses require payroll accounts, billing, database and much more. So, it would help to use a combination of Excel and a few other software to make your business run as smooth as butter!