Hiring and retaining competent and talented employees has been a top priority for any human resource department (HR) in an organisation. Hiring and retaining employees are two sides of the same coin; though you may be able to hire competent and talented employees, retaining them is a different matter to tackle.

To encourage employees to remain in an organisation, HR utilises one of its professional arsenals; an attractive compensation package that employees will find hard to refuse. According to research published by PWC Global, Hopes and Fears 2022, 71% of employees opinionated that the most important factor in a workplace is compensation and workplace benefits.

However, before you determine what compensation packages to offer, it is important to understand the definition and objectives of compensation.

The technical definition of employee compensation refers to the monetary payment provided in exchange for services provided by employees or hired hands. This includes salary in addition to any other incentives or perks that come along with the job or position.

When planning for employees’ compensation, you must first understand and decide the objectives for your employees' compensation — the purpose of it. This is so that your compensation is aligned with your intention and employees’ best interests.

In addition, there are four questions that you should consider and ask yourself when designing a fair compensation strategy:

The first question you need to ask yourself is, what counts as compensation in your company? This is because compensation is more than just providing monetary payment to your employees — it can be the ability to remote work, a hybrid work schedule, medical treatment coverage, or any other non-monetary benefits.

This combination of rewards and benefits is called employee total compensation (TC), offering both monetary and non-monetary rewards and benefits to employees in a company. The employee total reward is provided in addition to gross pay, it can include traditional benefits (medical and healthcare), voluntary benefits, retirement plans, vacation time, pensions, stock options or even equity.

To find out which rewards resonate well with your employees, conduct a company-wide survey to find out what are your employees' preferences for the employee total reward packages. As for the survey timing, it can be conducted six months before the enrollment period — this will provide you with ample time to evaluate and organise new offerings.

Most companies’ HR view such offerings as a part of the compensation package because they are informed of the associated cost. The hiring cost of a new employee goes beyond their salary; benefits and other compensation such as equity should be considered.

So when employees do not know about the costs like these, they will feel less inclined to view their compensation as competitive. This is when your company’s HR should share the employee's total reward statement. The total reward statement is an itemised one-pagers that will highlight all the benefits you are compensating your employees — in dollars, euros or pounds. The companies that provide employees’ total reward statements do so at least once a year.

They will typically list out the combined compensation made of monetary and non-monetary rewards given to the employees. For example:

• Salary

• Bonuses

• Commission

• Retirement benefits

• Stock options

• Paid time off

• Profit-sharing

• Employer-paid premiums for health, vision, and dental insurance

• Stipends

• Disability and life insurance

• Employer-paid Social Security and Medicare taxes

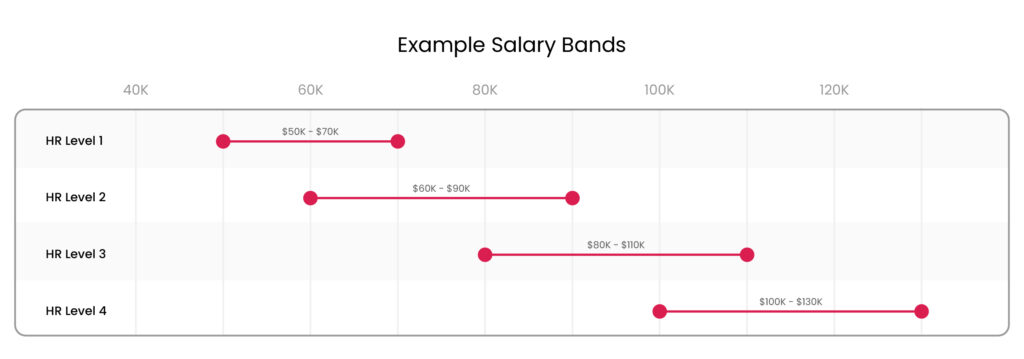

Salary or pay band refers to the minimum and maximum amounts a company is willing to compensate employees based on their job levels. For example, if job levels help you to set up a career path hierarchy for employees, salary banding serves a similar purpose as compensation.

For example, a Level 1 Designer at your company will be eligible to earn $50,000 to $70,000. While a Level 4 Designer, like an Associate Design Director, will be eligible to earn $100,000 to $130,000. These salary bands help define and communicate with employees and will allow them to understand their earning potential and how much their future promotion can provide.

A salary band like this serves an important purpose in your company’s compensation strategy. From a financial point of view, salary bands are vital for budgeting. This is because, without salary bands, your company will not be able to forecast overhead costs, plan a growth strategy or plan rewards for performing employees without risking your company’s financial health.

However, salary bands also serve an additional purpose. Salary bands are also used to facilitate your employees’ career development and pay conversations based on competencies and job levels.

In addition, and just as important, providing minimum-maximum salary ranges can help clear the ambiguity surrounding employees’ pay and help the HR team to identify and prevent pay disparities.

There should be several factors that influence your company’s salary bands, such as role expectations, education, experience and geography — all of which need to be backed by market research. There are also broader economic factors that should be influencing your company’s salary bands; inflation or cost of living — both impact a job’s market rates.

Besides the market rates and geography, you will want to take a look at each role’s skills and influence. Though it is typically assumed leadership roles warrant a higher salary than those in contributor positions, it is not always the case. For example, having a competent junior employee with high-in-demand skills that tangibly affect your business — warrants a salary that outearns managers in other departments.

Also, it is advisable to have a degree of flexibility in your salary band structure. For example, a Level 2 employee deserves recognition and promotion but is not quite ready yet. Their manager can instead reward an increase on par or similar to the next level starting salary because the salary band overlaps.

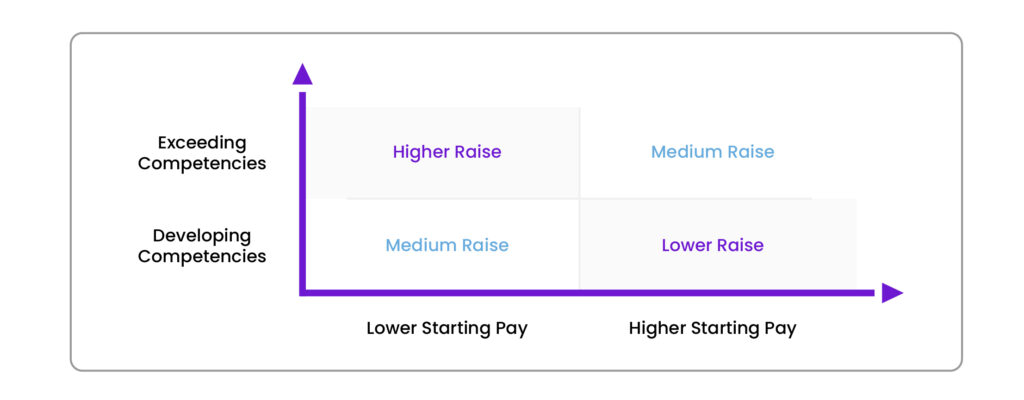

For the compensation model with merit cycles, where employees receive pay raises based on past performance. Such a compensation model is common, especially for sales roles. But it also can be divisive because some of the leading HR professionals believe that such a compensation model might hinder conversations related to growth and performance.

However, despite such beliefs, performance-based compensation models are growing increasingly popular among companies. In addition, according to a study's key finding, linking pay to performance or performance-based compensation increases employees' productivity and raises job satisfaction level.

Compensation is a very powerful motivator for employees, there’s no denying that. An attractive compensation will likely convince employees to continue providing their skills and talents to the company they’re working for. However, must bear in mind that compensation is not a sure and definite method to retain competent and talented employees.

As mentioned above, respectful treatment at the workplace is what most employees consider the most important. So, even if your company does an attractive compensation package but you’re not treating the employees with respect, employees will leave.

A study has shown that strongly linking attractive compensation with performance lead to greater employee satisfaction, trust in leadership and better motivation. The same study also showed a weak relationship between compensation (reward) and performance can be detrimental to employees' motivation.

Strongly linking compensation and performance will provide a tangible way for employees to see the benefits or improvements they bring to your company.

Performance-based compensation may be gaining popularity, but a majority of employers do not disclose it works to their employees. This lack of transparency will cause employees to feel frustrated. Hence, employers should provide a clear rationale to employees why they’re doing so.

In practice, a member of the HR team will need to announce and outline your company’s approach to merit increases during a company-wide meeting. Due to the personal nature of compensation, invite employees to anonymous questions before the company-wide meeting session and do a follow-up via email with clarifying points.

Planning to be clear about pay-for-performance also means equipping managers with talking points they need to field questions from direct reports during performance discussions.

There some critics claim that the pay-for-performance compensation model can distract employees from having meaningful performance conversations. Employers may counter this by limiting merit increases to specific quarters so they won’t overlap with performance reviews. In addition, separating the two will help provide time for employees and managers to process and evaluate how they have performed against the job competencies that your company has outlined.

Your company managers will require those contexts when deciding whether to approve a higher or lower increase.

One of the common complaints employees would make about compensation packages is that their employer doesn’t fully disclose it to them. However, the complaints are not necessarily about numbers, but more about how they do not understand how the pay increase gets determined. This makes disclosing and helping employees understand the calculus behind pay decisions a prerequisite to building trust in the process and believing that it is equitable. Simply put, “lack of transparency” is one of the main complaints often voiced by employees.

However, this is not limited just to individual contributor employees, but also the HR team. Their opinion is that most managers are not equipped for pay transparency conversations with their employees.

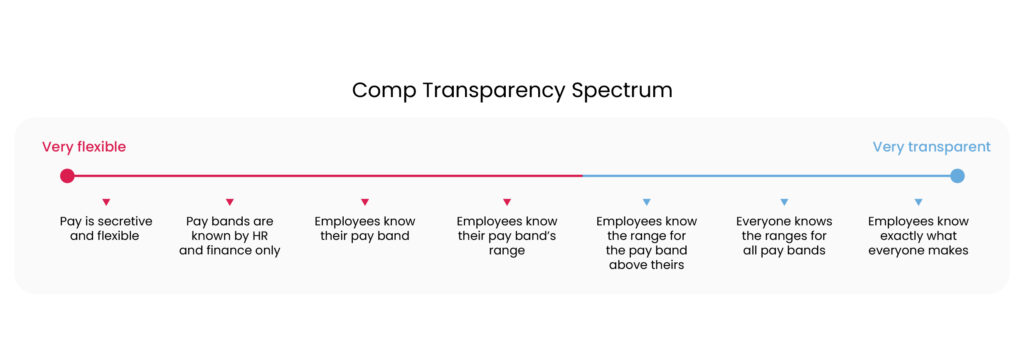

This is where pay transparency comes into play. Pay transparency is an approach companies take when communicating and conveying their compensation philosophies to employees. As we have mentioned before, employees do not necessarily want to know how much pay their peer earn, but this might be a favoured and good approach in some companies.

To help you understand pay transparency; pay transparency fall on a spectrum ranging from a very open model to a very closed one.

The current trend for the level of transparency is leaning towards more, not less transparency. Because even with a modest level of transparency; if it is still able to help employees understand how salary bands work and what factors influence when determining pay, they will be more inclined to trust the process.

Though a full or modest level of transparency might not work and be suitable for some companies, especially companies without a fully developed compensation strategy and system. This is because full transparency or even modest transparency made in front of the company will expose discrepancies in pay and compensation. The discrepancies however commonly originated from legitimate sources and reasons such as years of tenure, geography, or educational background.

The most important component in pay transparency conversations is communication. An HR team should reiterate their company’s compensation philosophies, including their approach to transparency, to employees — company-wide, during an advance performance review or upcoming compensation cycles.

A more practical level of transparency; might involve employees knowing and understanding their current pay band’s range and the one directly above them. This model of transparency will allow employees to understand their role’s potential earnings, and provide them with a realistic set of expectations during compensation conversations. This would be valuable information for the report’s manager to have since they will be coaching the employees.

In People strategy, the word “trust the process” carries additional meaning. Performance management is the best example here. A survey showed some companies exhibit gender, racial and religious bias; about 50% of female employees experience gender discrimination and 22% of female employees experience racial or religious discrimination at their workplace — hence cutting them off from proper compensation such as adequate maternity leave.

This happened because of the lack of formal review processes in some companies. Without the proper system, managers will fall back and rely on their “gut feeling” when making decisions for roles and compensations for their employees. Having proper compensation, performance and merit increase policies will provide your company with a headstart in the fight to pay for equity.

Additionally, salary bands will reinforce your commitment to pay equity in more obvious ways. HR and finance teams won’t be able to have a stopgap in place — to protect against out-of-control disparities, without minimum and maximum salary ranges assigned to each role. For example, a situation where there are two employees with the same role, but one of them earns more than the other without clear factors and reasonings. Such a gap could be from deliberate or unconscious bias, however, it could also result from less nefarious reasons — an inexperienced manager recommending more generous merit to increase their team. In either case, salary bands will be able to provide clear guidelines to follow, providing managers with a degree of flexibility when determining salary.

However, salary bands do not help in countering biases that can cloud and impair evaluations and future promotions. So if your company is planning to opt for linking performance and compensation, it is advisable to root out inequities during reviews.

One of the most helpful and impactful steps is to incorporate performance adjustments into your review cycles; where managers will come together for a discussion moderated by HR to discuss their reports’ performance rating. Since each manager will have different opinions and interpretations of what constitutes good or bad ratings, these discussions will help managers to go over these differences by requesting managers justify and explain their thought process and finally have everyone on the same page so that everyone will follow the same standard.

Compensation is important in how you attract and retain employees, but compensation is only of several pillars. Other pillars are just as important and where compensation can be integrated into; performance reviews, engagement surveys, check-ins, and development conversations.

However, getting all the mentioned programmes to work together in harmony will require a thoughtful and timely approach and execution. For example, your company arranges and schedules performance reviews and compensation decisions in alternating quarters. This is to avoid self-growth conversations with employees from getting sidetracked. Such an approach also will provide employees and managers with time to prepare and set growth plans and deliver them in time for promotion or merit increase.

Additionally, you can run engagement and pulse surveys year-round to provide you with insights into your total rewards strategy and whether you’re meeting employees' expectations. One crucial point to remember is that although your compensation is structured, it is not fixed and should have flexibility. Your employees' feedback should and can influence your compensation structure over time.

Compensation isn’t just about numbers, it is a critical and integral part of people management. Your employees will want to be properly rewarded for their efforts and services rendered.

But not having a proper structure or tools in place for compensation, it will be easy for your employees to feel demotivated and lose faith. Furthermore, companies without solid and proper compensation philosophies will struggle to come up with answers to key employee questions. Unclear compensation philosophies can breed distrust, suspicion of bias, disengagement and ultimately turnover.

So it is important to take a holistic approach to engagement, performance management and development and properly integrate compensation philosophies into them to create a thriving workplace.